From Ohio's CAUV hearings to the latest spring planting update, here's a rundown of our biggest news this week. News County auditors and farmers testify on CAUV bill.

MEDINA, Ohio— Many Medina County agricultural landowners may be surprised when they open their 2014 tax bills.

Soil type determination

For those on Current Agricultural Use Values (CAUV) program, property values have increased several hundred percent over 2010 CAUV values, depending on soil type. Ohio has approximately 3,500 soil types.

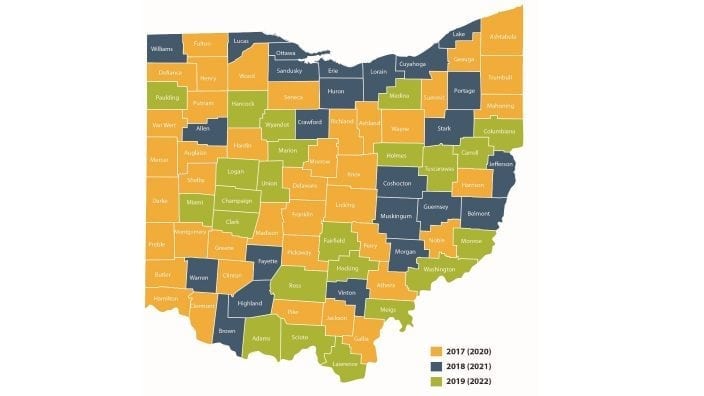

Instructions for the Renewal Application for CAUV General Information and Filing Requirements This application is to be used by the landowner to file for renewal of the Current Agricultural Use Value (CAUV) program pursuant to Ohio Revised Code section 5713.31. Under this program, the taxes on qualified land are. 2017 CAUV values by county and school district – Per Ohio Revised Code 5713.33, this workbook contains a spreadsheet with current agricultural use values aggregated by county, another spreadsheet with the CAUV values by school district, and a final spreadsheet listing school district names within each county within which they have territory.

Unlike fair market value appraisals, CAUV values are calculated by the State of Ohio Department of Taxation by a formula that is based on five factors. The CAUV soil rates allow land to be taxed based on its agricultural value, rather than fair market value, which is considerably higher.

No control

The county auditor has no control over the calculation performed by the state. The auditor’s role in this regard is simply to apply the results of the predetermined calculation from the Ohio Department of Taxation. The five factors the Ohio Department of Taxation uses in calculating CAUV land values are yield information, cropping patterns, crop prices, non-land production costs and the capitalization rate. CAUV rates are updated every three years and current rates were updated because of the state mandated 2013 sexennial reappraisal.

Significantly less values

Even with the significantly increased CAUV values, farmers are paying taxes on values significantly less than those not on the CAUV program. In 2012 the statewide average value for CAUV acreage was $994, compared to $3,044 per acre for agricultural acreage not in the CAUV program. Because the county auditor has no role in setting the CAUV values, there is no appeal available to land owners at the local level.

Questions

Additional information regarding CAUV values is available on the auditor’s website at www.medinacountyauditor.org.

For questions, call the auditor’s office at 330-725-9765 or visit at 144 N. Broadway St., Medina. Hours are Monday through Friday, 8 a.m.-4:30 p.m.

Medina County Cauv Program Ohio Locations

STAY INFORMED. SIGN UP!

Medina County Cauv Program Ohio Phone Number

Up-to-date agriculture news in your inbox!